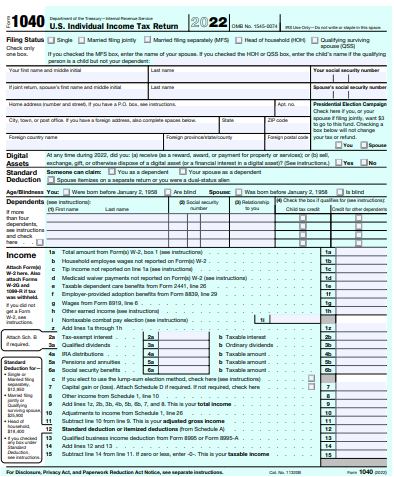

2024 1040 Schedule A – The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for . The person reporting the interest income must include the name, address and Social Security number of the person paying or receiving the money on line 11 of Form 1040, Schedule A. IRS Publication .

2024 1040 Schedule A

Source : thecollegeinvestor.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgPrintable IRS Tax Forms for 2023, 2024: Simplifying Tax Season

Source : fox59.comThe IRS Has Increased Contribution Limits for 2024 — Human Investing

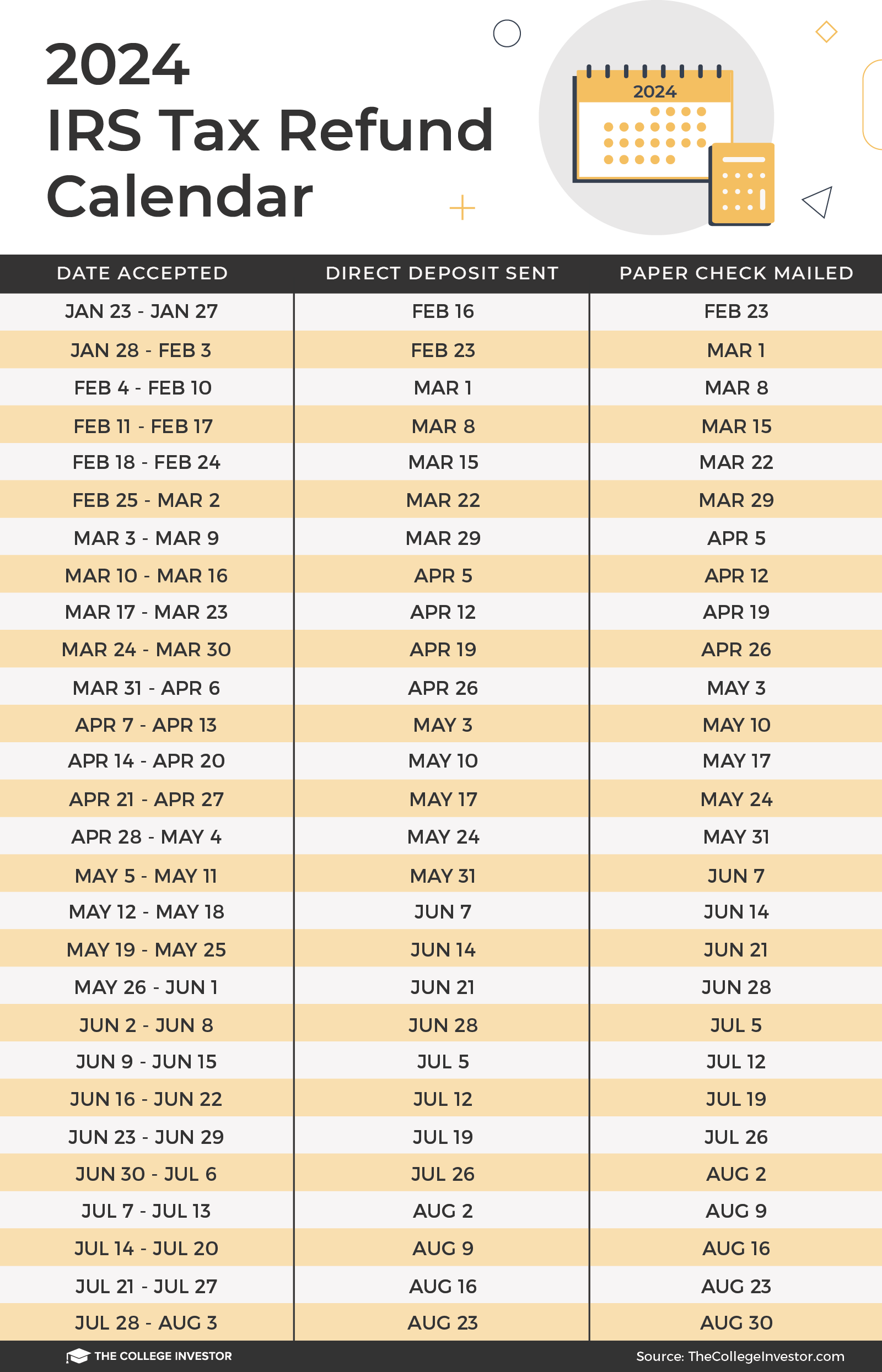

Source : www.humaninvesting.comIRS Refund Schedule 2024 Date to recieve tax year 2023 return!

Source : www.bscnursing2022.comIRS Refund Schedule 2024 Date to recieve tax year 2023 return!

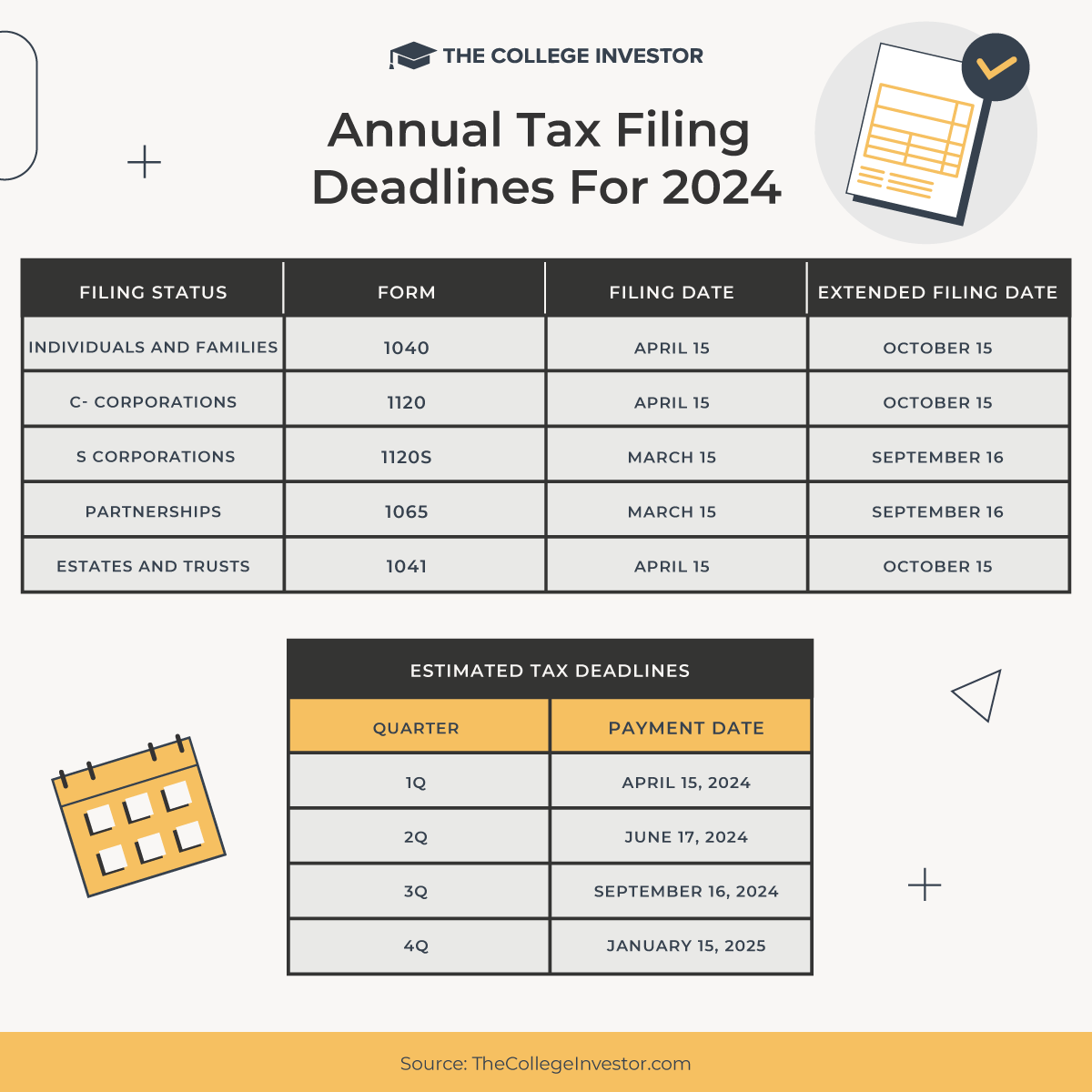

Source : www.bscnursing2022.comTax Due Dates For 2024 (Including Estimated Taxes)

Source : thecollegeinvestor.comForm 1040 For IRS 2024 | How To Fill Out Schedule A B C D

Source : nsfaslogin.co.zaFICA Tax Refund Timeline About 6 Months with Employer Letter and

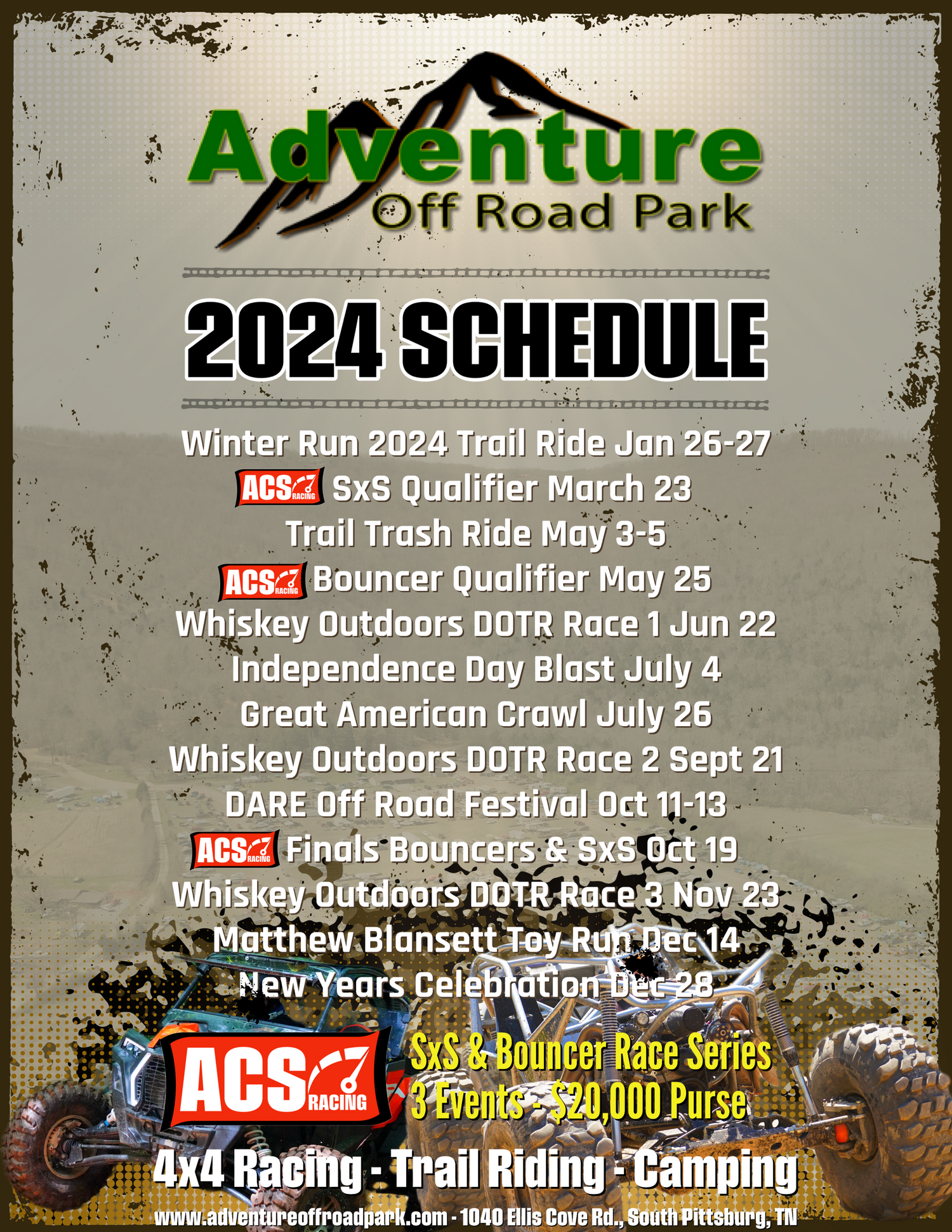

Source : thirstymag.comAdventure Off Road Park

Source : www.adventureoffroadpark.com2024 1040 Schedule A When To Expect My Tax Refund? IRS Tax Refund Calendar 2024: The money you win from placing bets on your favorite sports team is considered income, no matter how little. The IRS considers all winnings from gambling fully taxable, whether from a website, app, . Your 1040 will come with a number of schedules – like Schedule 1 and Schedule A – that are additional forms. Think of the 1040 like a math worksheet: You plug in various numbers from a .

]]>